🏡 Austin-Round Rock Market Update – What Agents Need to Know (May 2025)

The May numbers are in, and they paint a revealing picture of where the Central Texas housing market is headed. Whether you’re working with cautious buyers or strategic sellers, here’s what you need to know to guide them with confidence.

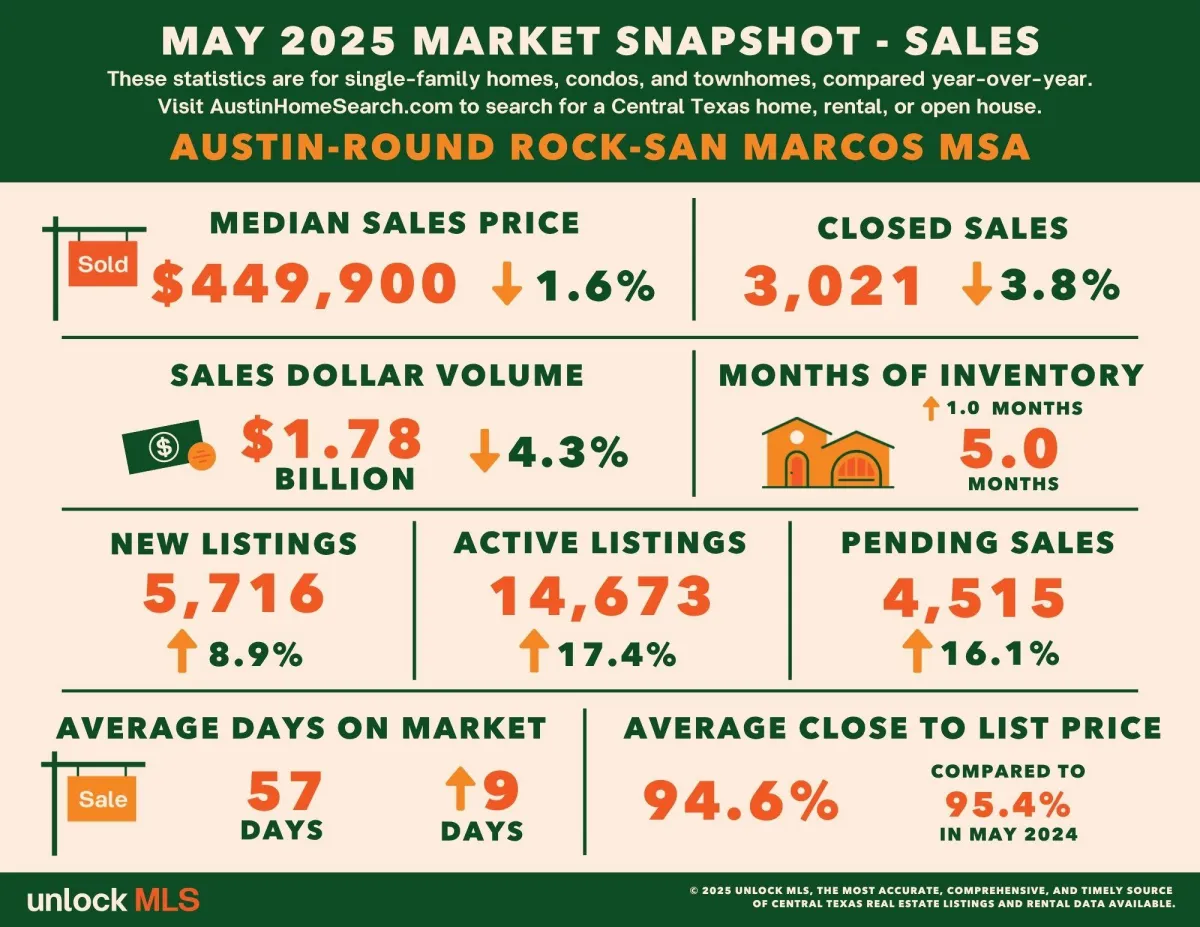

📉 Median Prices Down Slightly, Inventory Building

Median Sales Price: $449,900 (⬇️ 1.6% YoY)

Closed Sales: 3,021 (⬇️ 3.8%)

Sales Volume: $1.78B (⬇️ 4.3%)

Months of Inventory: 5.0 months (⬆️ from 4.0 months last year)

With inventory sitting at 5.0 months, the Austin-Round Rock market is inching closer to a balanced environment (typically considered 6 months). Buyers now have more breathing room, and bidding wars are no longer the default. That said, desirable properties in hot submarkets can still move quickly—pricing and presentation matter.

📈 Listings Surge, Buyer Activity Returns

New Listings: 5,716 (⬆️ 8.9%)

Active Listings: 14,673 (⬆️ 17.4%)

Pending Sales: 4,515 (⬆️ 16.1%)

We’re seeing signs that buyer confidence is rebounding, with pending sales making a strong move up. More listings mean more selection, but the increase in pending contracts suggests buyers are responding to improved inventory and anticipating lower rates.

🏦 Fed Update: Rate Cut in Sight?

More Fed members are publicly supporting a rate cut as early as July, assuming inflation behaves. This shift in tone has boosted mortgage bonds, signaling a potential improvement in rate pricing. Now is a good time to prep rate-sensitive buyers to move before demand surges again.

🏠 Price Trends & Appreciation Check

Case-Shiller Index: Down 0.4% in April (seasonally adjusted), up 2.7% YoY

FHFA Index: Down 0.4% in April, up 3.0% YoY

Big Cities Leading: 10-city index up 4.1%, 20-city up 3.4%

Price appreciation is moderating, but home values are still rising year-over-year. For sellers, it’s key to understand we’re not in a declining market—just a more rational one.

🔍 What This Means for Buyers and Sellers

For Buyers:

5.0 months of inventory = more options and negotiating leverage

Slight drop in median prices = better value

Longer days on market (57 avg) = time to shop and make smart offers

For Sellers:

Price to the market—overpricing leads to stale listings

Homes are still moving, especially well-presented ones

Average close-to-list price is 94.6%, a slight dip from 95.4% in May 2024

🧠 Final Thought for Agents

We’re no longer in a white-hot seller’s market—but we’re not in a downturn either. This is a balanced, opportunity-rich moment for both sides. Help your buyers act strategically while conditions are favorable, and guide your sellers to price smartly in a more competitive landscape.

If you need help structuring offers, updating pre-approvals, or running numbers for hesitant clients, I’m just a call or text away.