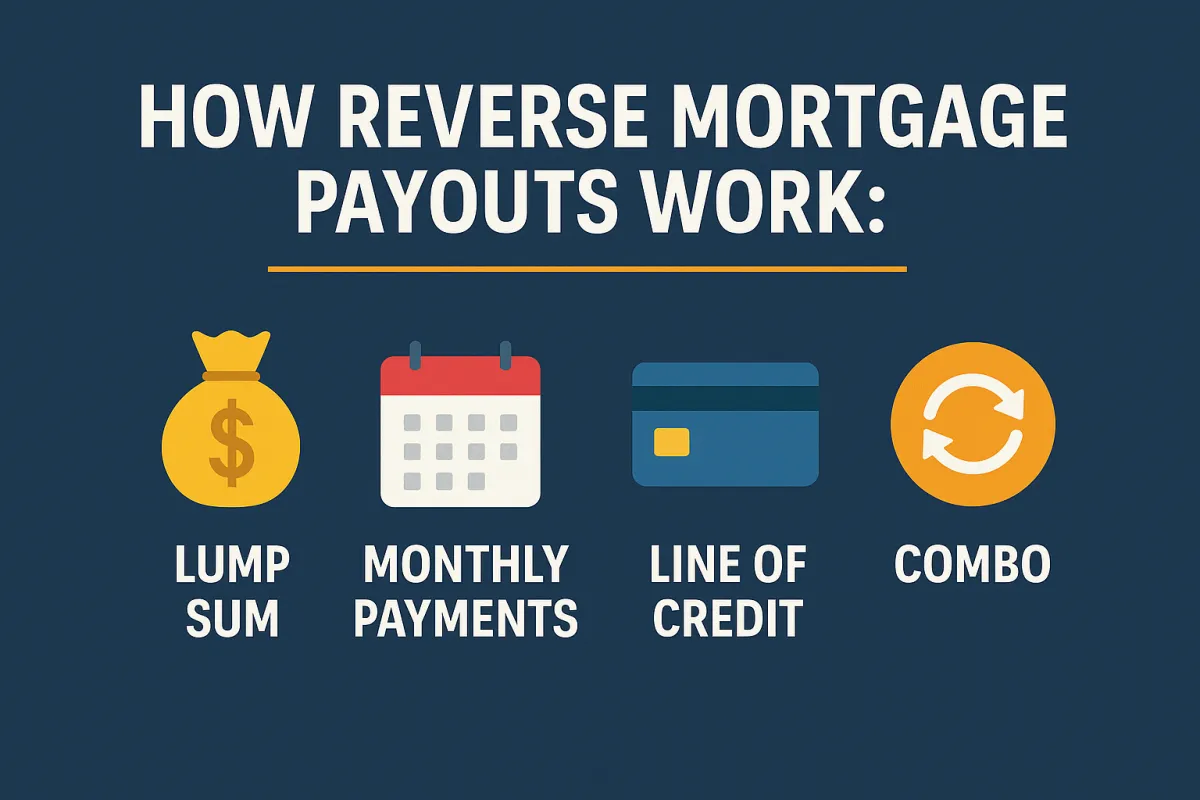

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

How Reverse Mortgage Payouts Work: Your Options Explained

A reverse mortgage gives you access to your home equity — but how that money gets to you is flexible.

Here are the 4 ways you can receive funds:

Lump Sum

Take all your available funds upfront — great if you want to pay off an existing mortgage, cover large expenses, or invest in one big goal.

Monthly Payments

Think of it like a paycheck in retirement. You’ll receive a set amount every month, creating consistent income.

Line of Credit

This is one of the most powerful tools.

You don’t pay interest on what you don’t use… and the unused line actually grows over time.

It’s like giving yourself a financial safety net that expands every year.

Combo Approach

Mix and match the options above.

For example: Take a small lump sum now, receive monthly income, and leave the rest in a growing line of credit.

Is It Taxed?

Nope. Reverse mortgage proceeds are considered loan funds, not income — so they’re not taxable.

Which Option Is Best?

That depends on your goals.

The right structure can support aging in place, reduce tax impact, and provide long-term peace of mind.

I’ll help you model it all out.

📲 Text me “Reverse Options” to 512-773-6729

👉 Or book time at apply.austensmith.com

Your trusted mortgage partner in Central Texas.

Quick Links

Home

ABOUT

APPLY

REFINANCE

RESOURCES

CONTACT

CONTACT

512-773-6729

APPLY

Austen Smith | Certified Mortgage Planning Specialist | NMLS# 265697

Barton Creek Lending Group | NMLS# 264320